December brought us some last-minute coding changes. In some cases, this caused a small claim delay as clearinghouses and payers scrambled to update their systems.

New ICD-10 Codes for COVID-19

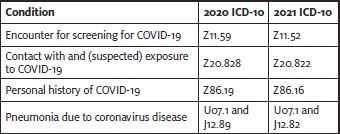

Effective January 1, 2021, there are new ICD-10 codes for reporting COVID-19 related diagnoses. These codes replace the existing codes we are using that are not as specific.

There are two other new codes:

- 81 (Multisystem inflammatory syndrome (MIS)); and

- 89 (Other specified systemic involvement of connective tissue).

For patients diagnosed with (MIS) and COVID-19, report U07.1 with M35.81 as an additional diagnosis.

If MIS develops as a result of a previous COVID-19 infection, report codes M35.81 and B94.8, (Sequelae of other specified infectious and parasitic diseases).

If the provider does not document that the MIS is due to the previous COVID-19 infection, report codes M35.81 and Z86.16.

If the patient has a known or suspected exposure to COVID-19, and no current COVID19 infection or history of COVID-19, report codes M35.81 and Z20.822.

Additional codes should be assigned for any associated complications of MIS.

Practices were able to start using these new ICD-10 codes with date of service effective January 1, 2021.

As a reminder, per official ICD-10 guidelines, a screening diagnosis (ie, Z11.52) is “generally not appropriate” during a public health emergency. Instead use the possible exposure code Z20.822, even for preoperative clearance. This is the same diagnosis code you would use to report actual exposure.

Changes to the E/M Add-on Codes

In addition to a 3.75% increase to the conversion factor, the Consolidated Appropriations Act, 2021 delayed implementation of the add-on code G2211 until 2024. This code would have been used for the additional complexity related to a patient’s single, serious condition or a complex condition.

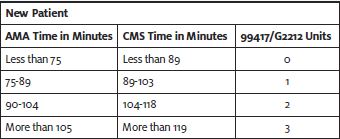

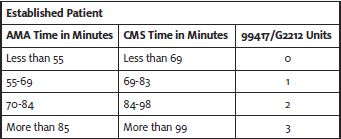

The Centers for Medicare & Medicaid Services (CMS) also created their own add-on code for prolonged services beyond the time defined by code 99205 and 99215. HCPCS G2212 should be used instead of CPT code 99417 to report these services.

+G2212 Prolonged office or other outpatient evaluation and management service(s) beyond the maximum required time of the primary procedure which has been selected using total time on the date of the primary service; each additional 15 minutes by the physician or qualified healthcare professional, with or without direct patient contact (List separately in addition to CPT codes 99205, 99215 for office or other outpatient evaluation and management services)

+99417 Prolonged office or other outpatient evaluation and management service(s) beyond the minimum required time of the primary procedure which has been selected using total time, requiring total time with or without direct patient contact beyond the usual service, on the date of the primary service, each 15 minutes of total time (List separately in addition to codes 99205, 99215 for office or other outpatient Evaluation and Management services)

The difference is that the American Medical Association recognizes “minimum time,” and Medicare recognizes “maximum time” for the level 5 codes. As a result, there will be two different time ranges, and code selection will depend on which time definition an insurance payer follows.

CPT 99417 would be reported to private payers unless their payer policies state otherwise.

More Vaccine Codes

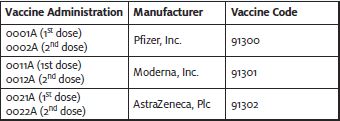

The AMA continues to add codes for reporting COVID-19 vaccines as products receive Emergency Use Authorization (EUA) from the U.S. Food & Drug Administration or get closer to being approved.

The structure is different from other vaccines. Each unique vaccine will have its own administration codes(s), depending on the number of doses.

All vaccines are reported with diagnosis code Z23 (Encounter for immunization).

Billing comes with its own challenges. While providers will not be paid for the product if they received it for free, some payers want the product code on the claim and others do not. If the product must be reported, it should be billed at $0.00 or $0.01.

CPT 99211 should not be reported when that is the only service performed. The work for the visit is captured by the administration code. Also reporting 99211 would be considered “double dipping.”

Private payers seem to be following Medicare’s lead on reimbursement. The payment rate for administration of a single-dose vaccine is $28.39. If two or more doses are required, the initial administration would be reimbursed at $16.94 and the final administration at $28.39.

Look for more information as more vaccines become available.